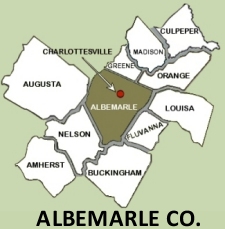

One of the questions that I am asked most frequently by buyers of a Charlottesville or Central Virginia home or horse farm, is what are the real estate taxes. In Central Virginia our real estate taxes are lower than they are in many areas of the country. However, there is quite a bit of variation between Charlottesville, Albemarle County and the surrounding counties.

Here is a list of the current county real estate assessments in the Central Virginia Counties.

Albemarle – 0.854/$100 of the assessed value.

Amherst – 0.61/$100 of the assessed value

Augusta – 0.63/$100 of the assessed value.

Buckingham – 0.55/$100 of the assessed value

Charlottesville – 0.95/$100 of the assessed value

Culpeper – 0.62/$100 of the assessed value

Fluvanna – 0.925/$100 of the assessed value

Goochland – 0.53/$100 of the assessed value (=.32 extra tax if Tuckahoe water/sewer lines)

Greene – 0.82/$100 of the assessed value

Louisa – 0.72/$100 of the assessed value

Madison – 0.70/$100 of the assessed value

Nelson – 0.72/$100 of the assessed value

Orange – 0.804/$100 of the assessed value

Rappahannock – 0.73/$100 of the assessed value

Rockbridge – 0.73/$100 of the assessed value

Rockingham – 0.74/$100 of the assessed value

Staunton – 0.95/$100 of the assessed value

The code of Virginia Section 58.1-3252 authorizes a county with a population of $50,000 r less to elect by majority vote of its board of supervisors to conduct a general reassessment of real estate at either 5 or 6 year intervals. Between reassessments the Commissioner is responsible for assessing any new construction or additions.

Please verify all rates as they may change.

Pam Dent

Pam Dent