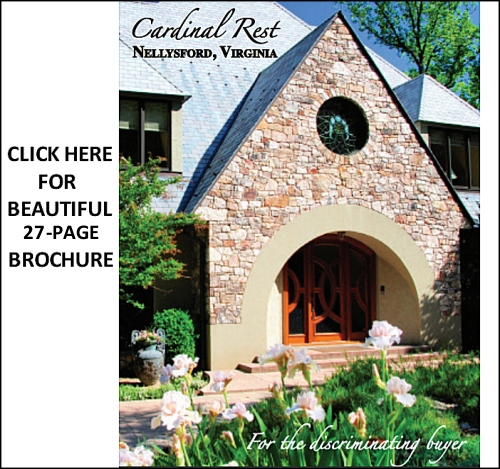

Now off market, but we have others

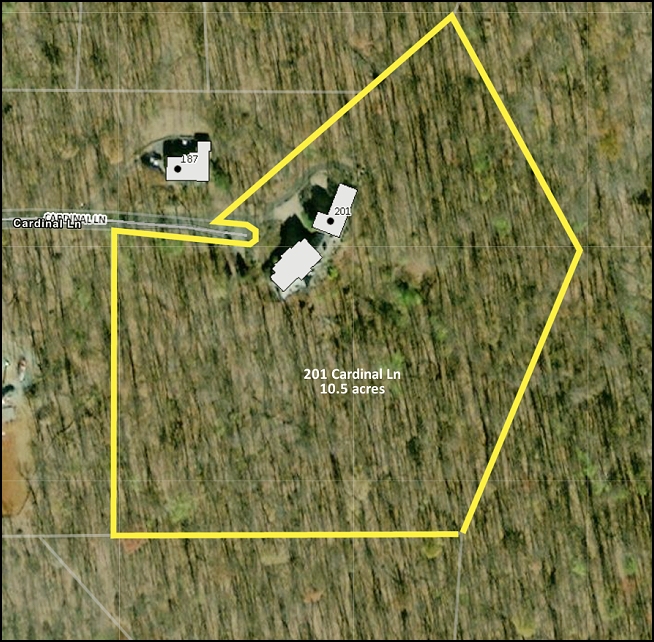

This spacious 16-acre estate is located in Nellysford, VA on a scenic byway in the Blue Ridge mountains. It is near Wintergreen Resort, wineries, breweries, orchards, and of course the breathtaking views of Nelson County. The Meeting Place 12,420 sq.ft. home was built initially as a boutique hotel, retreat, and teaching hub…. and now it could be a fantastic business or retreat or Airbnb as well. The home boasts 10 bedrooms, 10 bathrooms, 2 living rooms, an exercise room, conference space, computer room, greenhouse, and more.

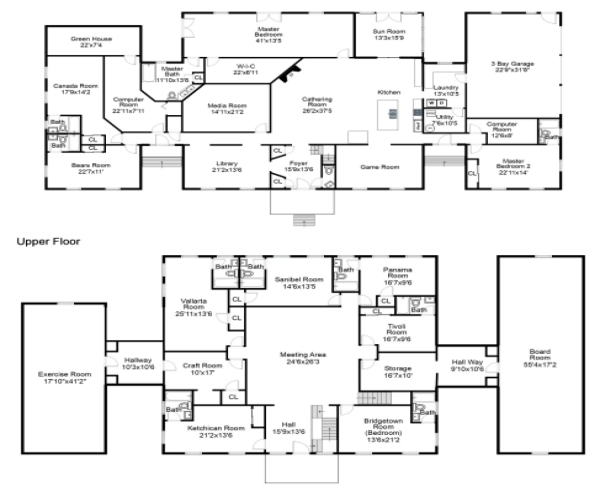

A large foyer on the main level leads to a great room centered around a fireplace, kitchen, dining, and sunroom. The first level is complete with a library, billiard room, media room, four ensuite bedrooms, powder room, work room with attached greenhouse, and laundry room/mud room.

The second level is inviting and spacious, with its own foyer and a charming balcony, a large living room, 6 additional ensuite bedrooms, an exercise/fitness room, a conference room and plenty of storage. There is also an attached three-car garage and a detached two-car garage.

Click To View Floor Plans

Co-listed with Bridget Archer 434-981-4149

The American bank robber, Willie Sutton, was asked why he robbed banks and his answer was “because that is where the money is.” During his 40-year career, he stole about $2 million but Internet scammers are stealing many times that amount in phishing schemes preying on unsuspecting home buyers.

The American bank robber, Willie Sutton, was asked why he robbed banks and his answer was “because that is where the money is.” During his 40-year career, he stole about $2 million but Internet scammers are stealing many times that amount in phishing schemes preying on unsuspecting home buyers.

Pam Dent

Pam Dent