The world of real estate can be daunting, but with enough preparation, anyone can make the dream of purchasing their first home a reality.

To prepare to buy your first home in Charlottesville, VA, research the real estate market trends in the area. After that, you should contact a mortgage professional who will calculate how much you can spend on a down payment, monthly mortgage, and closing costs. Getting pre-approved for a home loan is essential for a smooth home buying process.

Finally, to guide you through the complicated journey of buying your first home, get in touch with an experienced local realtor in Charlottesville.

What Is the First Step You Should Take Before Buying a Home for the First Time?

The first thing you should do is learn about the available programs from the state Virginia Housing (formerly Virginia Housing Development Authority or VHDA). These programs are geared toward first-time homebuyers.

First-time homebuyers in Virginia have access to a wealth of benefits and grants (no pun intended) that make your purchase possible:

- Down payment grants

- Zero down payment

- 30-year fixed-rate loans

- Federal tax breaks

Eligibility is dependent on these criteria:

- No history of homeownership in the past three years

- Credit score of at least 620

- Compliance with maximum income and loan limits

- Property will serve as your primary residence

- Completion of homeownership education class

What Are the Steps in the Home Buying Process?

If you’re looking into buying a home in Charlottesville, Virginia, it’s best to know and understand each step in the process first.

1. Calculate What You Can Afford

Before you start shopping for a home, calculate how much you can spend on a house and your monthly mortgage. A mortgage professional is essential to assist you with this.

2. Get Pre-approved for a Mortgage

Getting pre-approved for a mortgage will let you know exactly how much money you can spend on purchasing a home.

3. Come Up With a Wish List for Your Home

Having a wish list with all the features and amenities you want will help narrow down your home options. However, remember that you might need to compromise according to your budget, particularly in the current low inventory real estate market.

4. Find an Experienced, Local Real Estate Agent

You don’t have to go blindly into buying your first home! Working with a local real estate agent will help make the home buying process smooth and efficient.

5. Search for Charlottesville, Virginia Homes for Sale

A real estate agent will introduce you to homes that fit your budget and comply with your wish list.

6. Negotiate an Offer

A critical step in the home buying process is making the offer. Real estate agents specialize in negotiating the sale’s price, terms, and conditions in favor of their client.

7. Get Mortgage Approval

Once you have a home under contract, get back to your lender to proceed with the mortgage.

8. Order a Home Inspection

Ordering a home inspection will help you identify whether any major repairs need to be made to the home and any potential or existing conditions that affect the property’s value.

An inspector should advise you on the necessary maintenance and upkeep.

9. Complete the Closing

Once all the above steps are done, expect to sign a lot of paperwork to complete the transaction.

What Do You Need to Buy a House for the First Time in Virginia?

Here are some things you need to do when buying a home in Virginia for the first time.

1. Do Your Research

To buy a house for the first time in Virginia, you need to do your research.

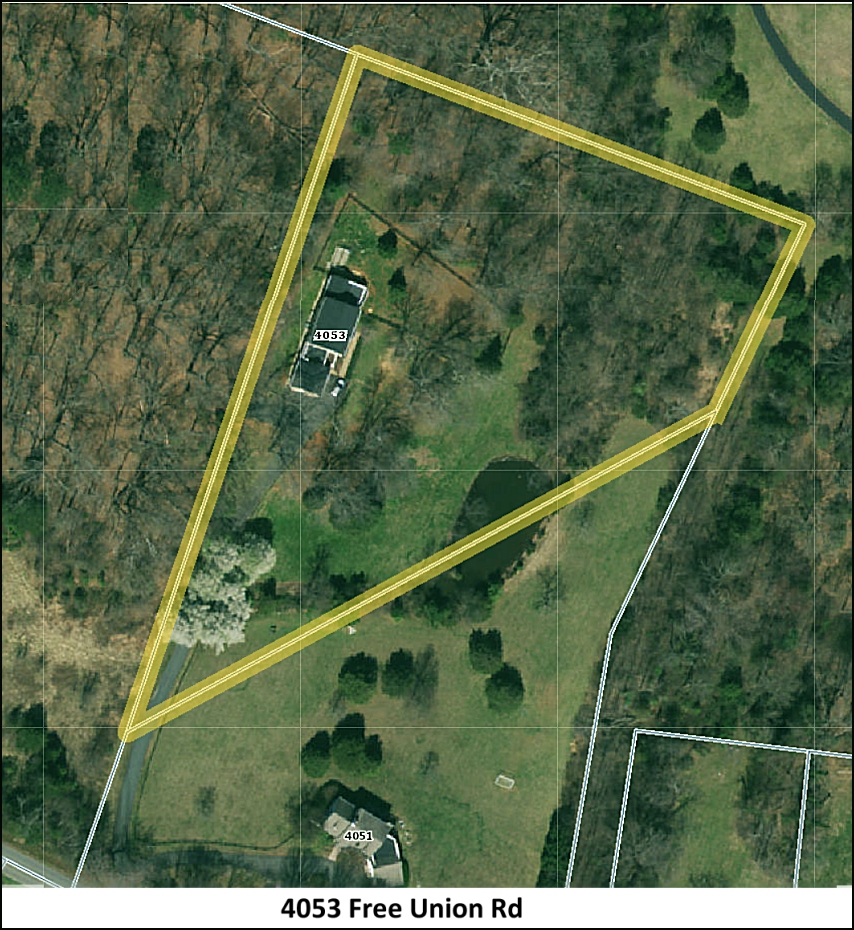

Before settling in the city of Charlottesville in Central Virginia, make sure that the Charlottesville lifestyle is right for you.

Charlottesville, VA is a thriving community that values arts and culture and innovation grounded in tradition. Residents get a balance of urban and rural living, as just beyond the city lines lie acres of family farms and rolling hills.

Before you hire a real estate agent, visit websites and read newspapers and magazines to get an idea of available real estate listings in Charlottesville. Follow all the homes you’re interested in, and check back to see how long they stay on the market.

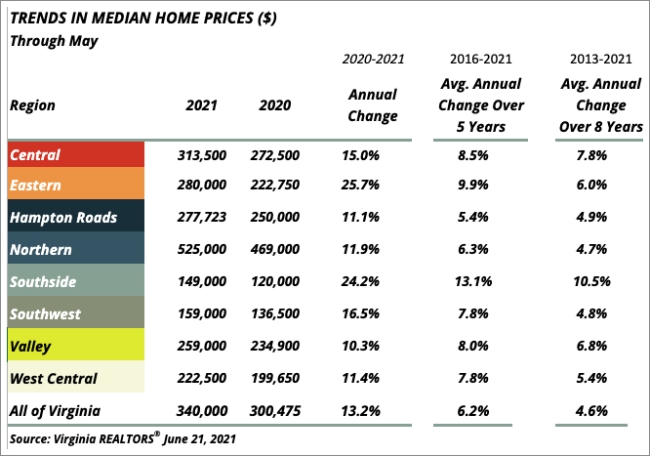

This will give you an idea of the current housing market in Charlottesville, VA.

2. Calculate Your Budget and Save Up

Buying a house means that you need cash to make a down payment. You’ll also need to save up for upfront costs such as:

- Mortgage applications

- Real estate agents

- Lawyers

- Home inspections

- Moving expenses

- Insurance

- Closing costs (interest, property taxes)

- Starting utilities

- Emergency funds

Because of these many expenses, you need to figure out exactly how much you can afford, taking into consideration average home prices in Charlottesville, your income, expenses, and goals.

Down payments on homes range between 3.5% to 20% of the total cost of a property. This will depend on a homebuyer’s:

- Mortgage interest

- Credit score

- Income

- Current financial situation

- Type of loan

To figure out the hypothetical downpayment for a home, find the average price for a home in Charlottesville, VA, and take 20% of that rate. According to Realtor.com, the median listing home price for Charlottesville, VA homes is $437,000. Or better yet reach out to a mortgage professional who can calculate how much you are able to spend and what loan product is best for you.

As for closing costs, they are calculated approximately 2% to 5% of the purchase price.

3. Attending Homeownership Education

Attending free homeownership classes is essential to not only qualifying for a home loan but will also help you understand your personal finances.

As a general rule of thumb, it’s recommended that buyers aim for a property that costs no more than 2.5 times their gross annual salary.

Homeownership education will also help you create a personal spending plan that works for your personal goals.

4. Preparing for a Mortgage

Since buying a home for the first time is a major investment, you will need to prove your financial capacity through your credit score, income, assets, and equity.

The credit score is used by lenders to determine the “creditworthiness” of borrowers or simply their capacity to repay the debt. A high credit score means that a person is financially trustworthy, while a person with a low credit score will have a more challenging time securing a loan.

There are several ways to improve your credit score to avoid any problems with securing a loan:

- Paying your balances

- Requesting a credit limit increase

- Check for errors in your reports

Otherwise, another solution to buying a home with a poor credit score is to save up for a larger down payment. An additional option would be to apply for a Federal Housing Administration loan, which allows homebuyers a minimum credit score of 580 and a credit score of 3.5%.

To avoid any problems in the home buying process, get pre-approved by your lender. Remember that sellers do not tend to work with potential buyers who have not yet secured pre-approval.

5. Work With a Real Estate Agent

The best way to prepare for the intense journey of buying your first house is to get the guidance of a professional real estate agent. Working with an agent means that you’ll most likely find a home that suits your budget and needs from the get-go.

Buying a home can be complicated and overwhelming, especially if it’s your first time. A real estate agent will help you deal with legal paperwork, clean up your credit score, and find financing.

Since you’ll be working with an experienced professional, you’ll save hundreds of hours researching properties, the neighborhood, local zoning laws, and even assessing a property’s physical condition.

Final Thoughts

A real estate agent will work in your best interests to secure a deal in line with your price range and future goals. If you’re hoping to buy your first home in Charlottesville, VA, get in touch with me, Pam Dent, at 434-960-0161.

Pam Dent

Pam Dent