An Adjustable Rate Mortgage (ARM) is not as common as a Fixed Rate (i.e, 15 or 30 Year Mortgage), but an ARM may be a better choice for a homeowner who knows they are going to stay in the home for less time than the break even point.

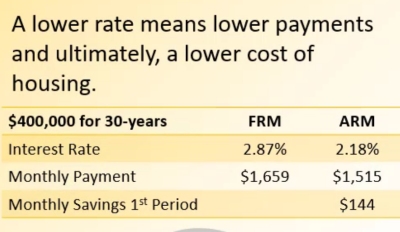

An ARM might easily be 1/2% less than a fixed-rate during the first period of the loan, which can reduce the monthly cost of housing compared to a fixed rate.

The actual rate of an ARM can go up or down during the life of the loan, depending on an independent financial index. If the index rate is higher on the anniversary of your mortgage, the rate of your ARM could go up. But if you believe that rates are going to trend down during the time you own the home, then an adjustable rate could be to your advantage.

A mortgage financial advisor can provide you with a comparison of an Adjustable Rate vs a Fixed Rate to estimate when a Fixed Rate would have been a lower way to finance. There is a breakeven point in terms of months and years.

The ARM may be a better choice for the homeowner who knows they are going to stay in the home less time than the breakeven point. But if you plan for this to be your Forever Home, a Fixed Rate will likely be the better choice. If you’d like a recommendation, please let me know.

M/p>

Pam Dent

Pam Dent