A successful home sale, considered by many owners, is to maximize their proceeds in the shortest time with the least inconveniences. Just because it is a seller’s market doesn’t mean that homeowners can shortcut some of the steps that make it happen and they certainly need to avoid commonly made mistakes.

Pricing too high

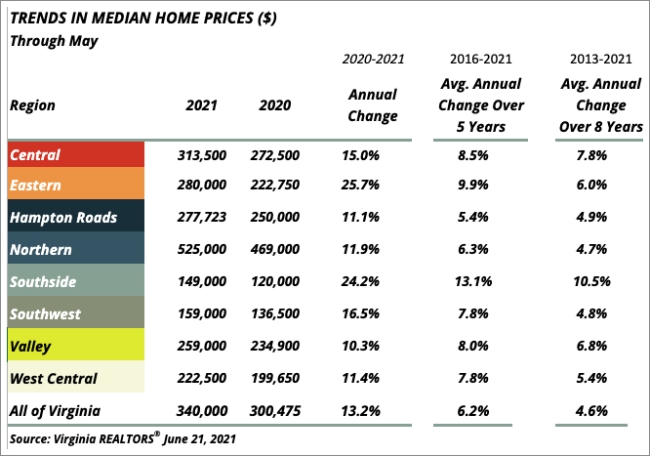

Low inventory and high demand have contributed to the rising prices of homes. NAR reports that the median sales price is up 17.8% in the past year and CoreLogic recently released data that July set new record growth of 18% year over year. This might give sellers a false sense of security about overpricing their home

Pricing a home too high initially can limit activity, attract the wrong buyers and ultimately, cause the home to realize a lower price than optimum. There is an interesting dynamic that takes place when there is a shortage of homes to show, and a new home hits the market. Buyers, who have been in the market but not purchased yet, will rush out to see the home. They are familiar with what homes are selling for and possibly, have even lost bids on one or more.

These savvy buyers expect certain amenities based on the price of the home. They can tell if a home is priced right or not.

Failure to do Market Preparation

There are people who will buy a home that is not pristine and does not have everything in good working order, but they usually will not pay top dollar for the home. They recognize the money that needs to be spent and will adjust the price accordingly.

To command the highest price, the home needs to be spotlessly clean with everything working as it should be. The home needs to be depersonalized to appeal to the broadest group of people. The clutter needs to be removed so it isn’t distracting or give the impression that the rooms, counters, or closets are small.

It is important to evaluate if painting is necessary along with replacing floor covering, appliances and/or light fixtures.

Thinking the agent doesn’t matter

Market time is down to 17 days and 89% of homes are sold within a month. These statistics might be used to rationalize that an agent is not currently playing an important role in the home but that would be a mistake.

Nine out of ten homeowners use an agent, and the four most important reasons were to help sell the home within a specific timeframe, help price the home competitively, help seller market the home to potential buyers and help the seller find ways to fix up home to sell it for more money.

Being present during showings

It may not be convenient, but sellers should try to leave the home when it is being shown. Buyers like to look at the home freely and ask questions or point out things to their agent. Sellers may have the best of intentions, but they have not established rapport with the buyer and don’t really know what is causing the questions.

Not letting your agent negotiate for you

The role the agent plays as third-party negotiator is one of the most important things an agent does for a seller. It begins long before buyers even make an offer. The protocol is for the buyer’s agent to go to the listing agent with the question and if necessary, they can ask you and get back to the buyer’s agent.

Buyers and sellers have inherently different objectives. Sellers want the highest price and buyers want to pay the least. Sellers want the terms of the contract in their favor and the buyers want them to favor them. Buyers want lots of contingencies to let them out of the contract and sellers want the fewest possible contingencies. Sellers want the most earnest money and buyers want to put up the least possible.

Agents are skilled at negotiation not only because of training but also experience. Sellers’ experience is usually limited to personal transactions separated by years in frequency. Agents see multiple transactions in their daily business and can guide people through difficult areas.

Not responding to offers in a timely manner

Normally, an offer can be withdrawn, at any time, up until the point that it is accepted. The expression a bird in the hand is worth two in the bush reminds us that the offer you have is real and the ones in the bush, may never come to fruition.

A common situation occurs when there is large amount of activity on the home and an offer comes in quickly. Instead of negotiating on that offer, the sellers wait to see if any better ones are received. By waiting, the seller runs the risk of the buyer changing their mind.

Alternatively, in the same situation described, the seller may decide to put the home on the market on Saturday morning and let prospective buyers know that they will be deciding on all offers received over the weekend on Sunday evening.

Your agent is a valuable part of selling a home who can offer advice, bring perspective to the transaction, and suggest different ways to help you achieve your goals. Once you have the right agent, everything else will start to fall into place.

Sometimes, as people approach the inevitable, they start trying to get their things “in order”. They may even have a will, but they decide to transfer title to real estate prior to their death which could be an unnecessary expense for the would-be heir.

Sometimes, as people approach the inevitable, they start trying to get their things “in order”. They may even have a will, but they decide to transfer title to real estate prior to their death which could be an unnecessary expense for the would-be heir.

Pam Dent

Pam Dent