NOW UNDER CONTRACT BUT WE HAVE OTHERS

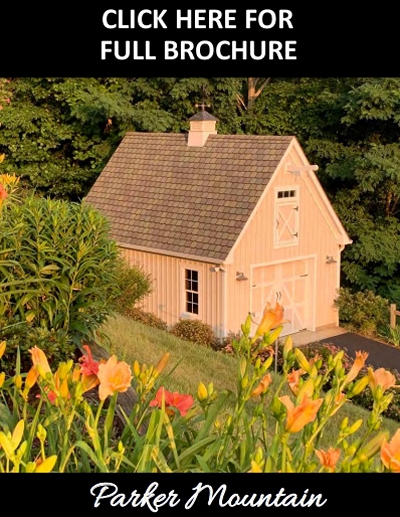

Enjoy majestic views of the Blue Ridge Mountains from this amazing property located on 13 acres on the slopes of Parker Mountain in the picturesque countryside of Greene County, Virginia.

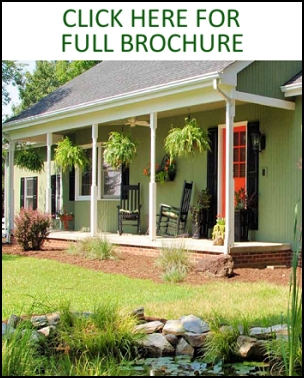

The stunning all-brick 3-bedroom 3.5-bath home features amazing mountain views. Unique craftsmanship is evident throughout, with custom interior trim, hardwood floors in the living areas, high ceilings, and arched doorways. Other amenities include a beautifully appointed kitchen with granite countertops and upgraded appliances. The main floor offers an inviting living room with beamed ceilings, a stone gas fireplace, and built-in cabinetry. Coffered ceilings enhance the lovely formal dining room. The second level has the spacious master suite plus two additional bedrooms with a shared bath. All baths are tiled with enclosed showers and granite countertops. There is also a convenient home office. Large wraparound porches, accessed from all rooms on two levels, invite you to linger and enjoy the mountain vistas. The terrace level has a large family room and full bath. A three-story elevator provides ultimate accessibility.

There is a focus on relaxing and entertaining on the very large brick patio and separate deck.

The home is extremely energy efficient with a geothermal and zoned HVAC system, thicker exterior walls with extra insulation, and upgraded thermally efficient windows. There is a three-bay garage and a large detached outbuilding (mini-barn) for workshop or crafts with an attic storage space. The beauty of the property exhibits the eye appeal of mature landscaping, an all-brick exterior, and an architectural roof. This gorgeous property is located an easy 25-minute drive to Charlottesville.

Co-listed with Bridget Archer 434-981-4149

Pam Dent

Pam Dent